Wallet Tracker: More than one-in-three Canadians say their household finances are getting worse

January 7, 2026 (Toronto, ON) – A new national Liaison Wallet Tracker survey finds Canadians are entering the year with a sour view of their household finances. Nearly four in ten say their financial situation is worse than it was 30 days ago, while only a small minority say things have improved.

“People are doing the math every day, at the grocery store, at the gas pump, and when the bills come in,” said David Valentin, Principal at Liaison Strategies. “What stands out is how few Canadians are saying they’re better off month-over-month, and how consistently cost-of-living pressures show up as the dominant source of stress.”

Conducted from December 26, 2025 to January 3, 2026 using Interactive Voice Response (IVR), the rolling survey polled 1,000 Canadians, with the sample split evenly between two weeks (500 per week). The margin of error is ±3.09 percentage points, 19 times out of 20.

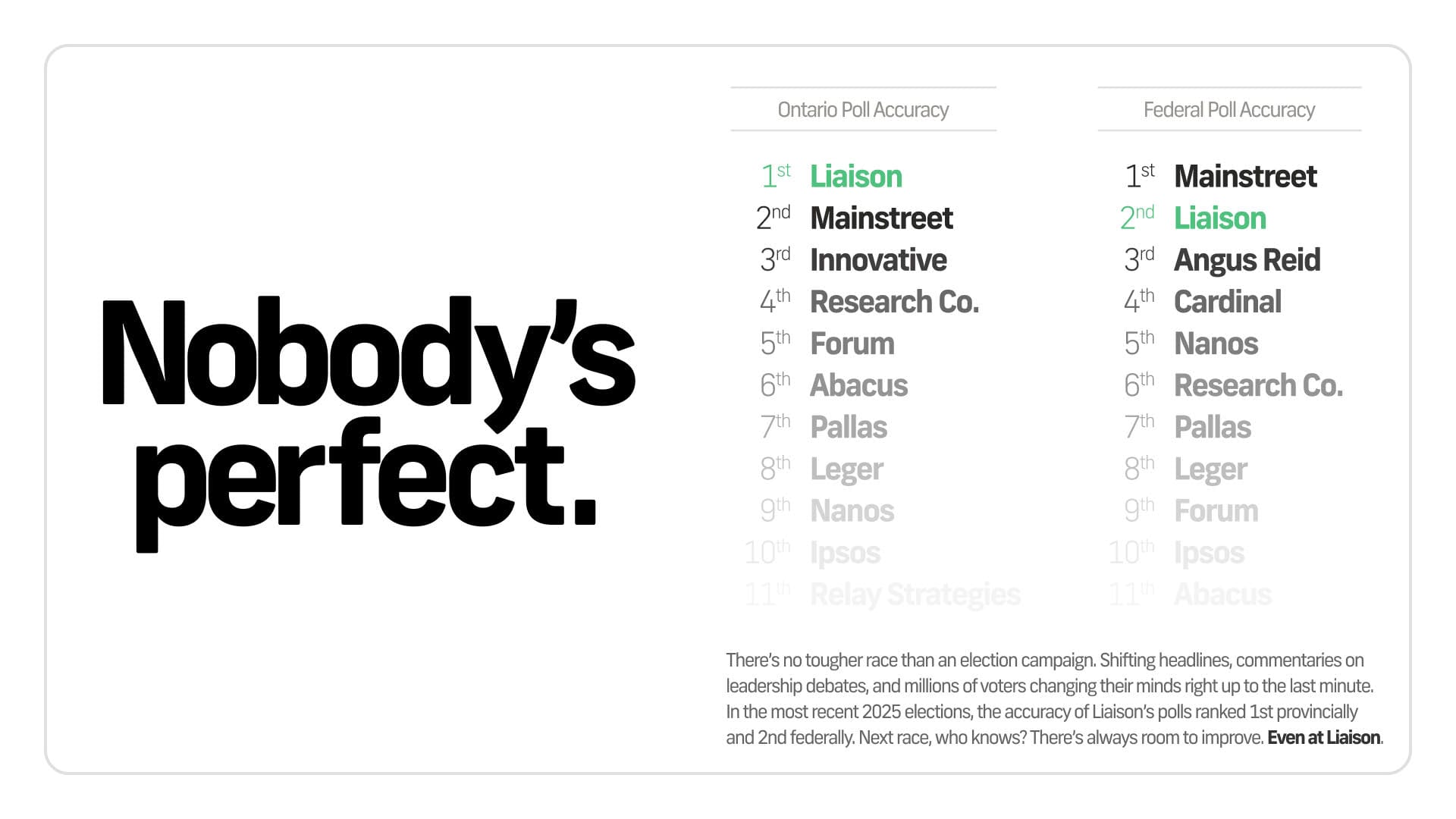

Liaison Strategies is one of the most accurate polling firms in Canada. It ranked #1 in accuracy in the 2025 Ontario election and #2 nationally in the 2025 federal election. Liaison is a member of the Canadian Research Insights Council (CRIC).

Key findings

Household finances (vs. 30 days ago)

- 37% say their household financial situation is worse

- 45% say it is the same

- 14% say it is better

- 3% are not sure

Young adults are most likely to report a decline. Among Canadians aged 18–34, 45% say they are worse off, compared with 24% of seniors aged 65+.

Regionally, British Columbia stands out with 43% saying their finances are worse, while Manitoba/Saskatchewan is the least negative, with 22% saying worse and 20% saying better.

Confidence in meeting financial obligations (next month)

- 71% are confident they can meet all obligations (18% very, 53% somewhat)

- 26% are not confident (12% not very, 14% not at all)

While most Canadians say they can make it through the month, B.C. again stands out: 35% say they are not at all confident, far higher than any other region.

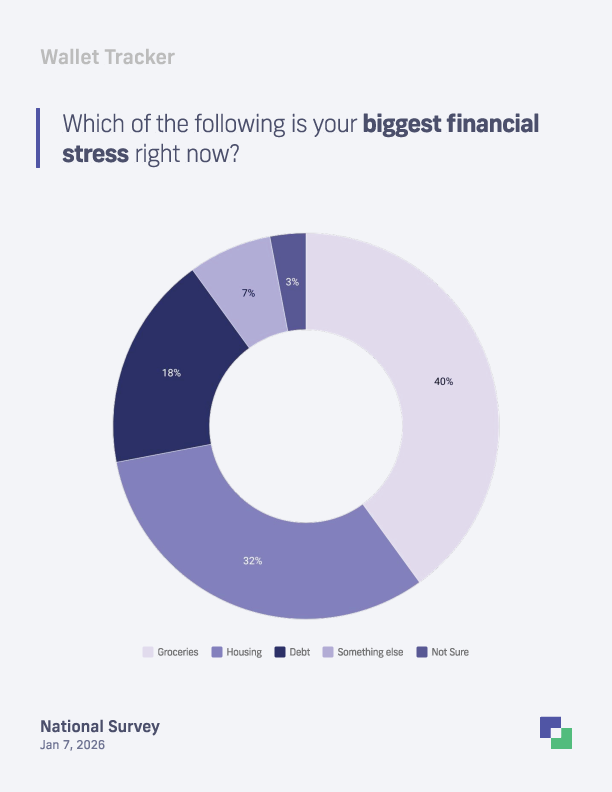

Biggest financial stress right now

- Groceries: 40%

- Housing: 32%

- Debt: 18%

- Something else: 7%

The stress picture shifts sharply by age. Seniors (65+) overwhelmingly cite groceries (61%), while younger Canadians (18–34) are most likely to cite housing (41%).

"People experience the economy through receipts and right now, after the holiday season, can be particularly tough. When more than one-in-three say they’re worse off than they were just 30 days ago, and only a small minority say they’re better off, we can see Canadians are being squeezed," continued Valentin.

"What’s also important is the shape of that stress. Groceries and housing dominate for a reason: they’re the costs you can’t opt out of. Most Canadians still say they’re confident they can cover next month’s obligations, but a quarter aren’t and that gap is where anxiety lives," concluded Valentin.

Detailed Poll Report:

About Liaison Strategies

Liaison Strategies is a national public opinion research firm. With 12 years of experience in Canadian polling, David Valentin, principal, has fielded hundreds of projects at the municipal, provincial and federal levels and appeared across Canadian media to discuss insights. Liaison is a member of the Canadian Research Insights Council (CRIC), Canada’s voice of the research, analytics, and insights profession both domestically and globally.