Holiday spending hangover, most Canadians worried about credit card bills and debt in 2026

January 15, 2026 (Toronto, ON) – A new national survey from Liaison Strategies suggests many Canadians are entering 2026 feeling financially stretched after holiday spending in late 2025, with most expressing concern about paying off upcoming credit card statements and warning that credit card debt poses a real threat to the broader economy.

The polling shows that while a plurality say they took on new debt but expect to pay it down soon, a significant share say they took on new debt and are not confident they can pay it back, a warning sign for household stability as interest rates and everyday costs continue to bite.

"Canadians are feeling the squeeze, and a meaningful share are carrying holiday debt into the new year with real anxiety about making their next payments," said David Valentin, Principal at Liaison Strategies. "What should worry policymakers is not just the household-level stress, but the broader economic signal."

Liaison surveyed a random sample of 1,000 Canadians from January 2 to January 10, 2026, using Interactive Voice Recording (IVR) technology. To ensure a representative sample, participants were reached through random digit dialing (RDD) across both landline and cellular phone networks. Each week, the rolling survey refreshes the sample by adding 500 participants and removing 500. The margin of error is ±3.1 percentage points, 19 times out of 20.

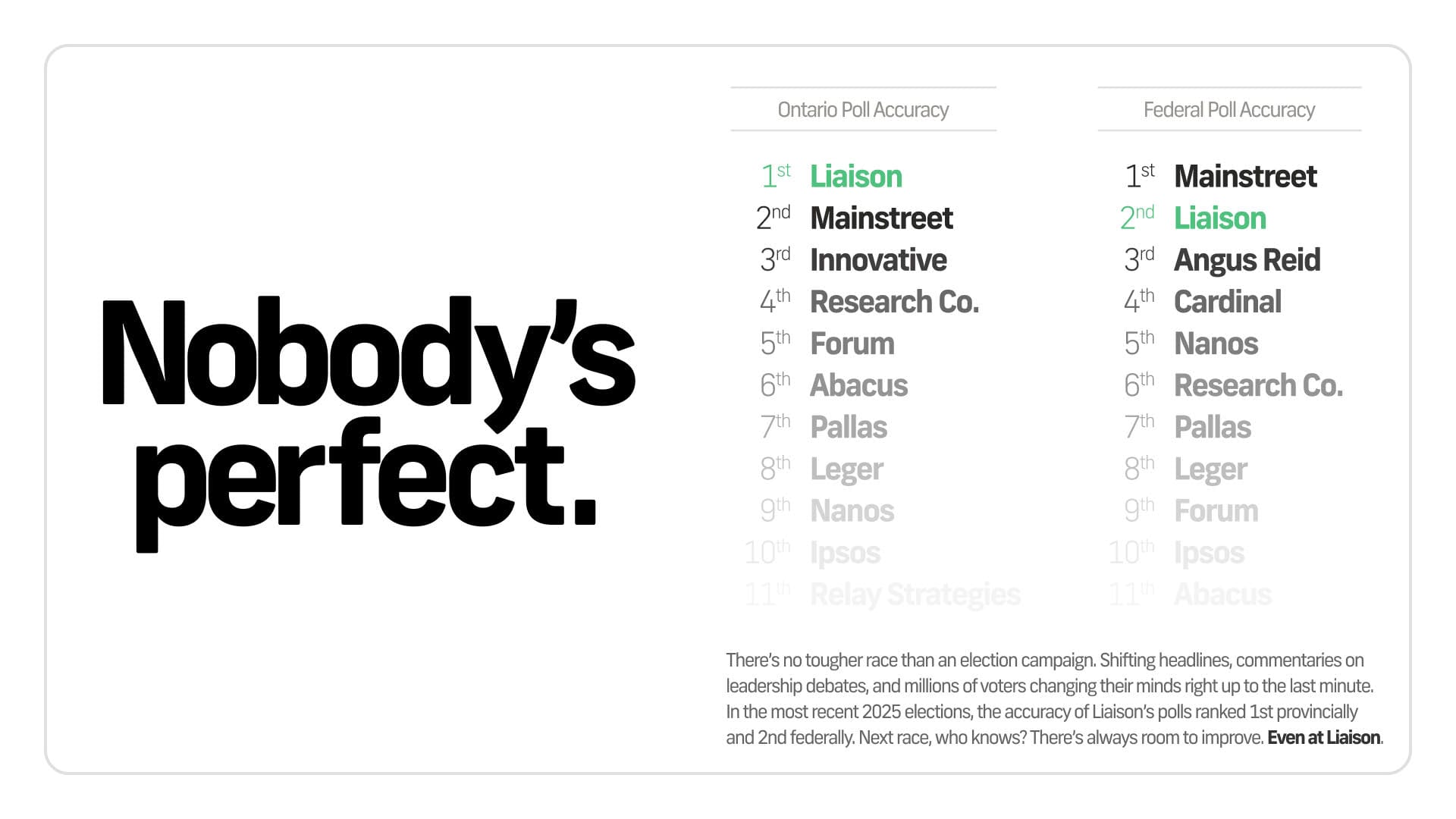

Liaison Strategies is one of the most accurate polling firms in Canada. It ranked #1 in accuracy in the 2025 Ontario election and #2 nationally in the 2025 federal election. Liaison is a member of the Canadian Research Insights Council (CRIC).

Key Findings

- Debt Anxiety: Only 19% of Canadians report being "not at all concerned" about paying their January credit card statements in full.

- Economic Warning: 45% of the country views credit card debt as a "major threat" to the overall Canadian economy this year.

- Emergency Fragility: 11% of Canadians report they would be completely unable to pay for an unexpected $500 emergency expense.

- Regional Concerns: Perception of debt as a major economic threat is highest in British Columbia (57%) and Ontario (52%).

- Generational Divide: 52% of Canadians aged 18–34 expect their total household debt to be higher by the end of 2026, compared to just 33% of those aged 65 and older.

"We are seeing a notable regional and generational divide in how Canadians view their financial futures," Valentin added. "In provinces like British Columbia and Ontario, over half the population now views consumer debt not just as a personal hurdle, but as a systemic risk to the national economy. With over half of young Canadians expecting their debt to climb even higher by next Christmas, the pressure on discretionary spending is likely to persist throughout the year."

Detailed Poll Report:

About Liaison Strategies

Liaison Strategies is a national public opinion research firm. With 12 years of experience in Canadian polling, David Valentin, principal, has fielded hundreds of projects at the municipal, provincial and federal levels and appeared across Canadian media to discuss insights. Liaison is a member of the Canadian Research Insights Council (CRIC), Canada’s voice of the research, analytics, and insights profession both domestically and globally.